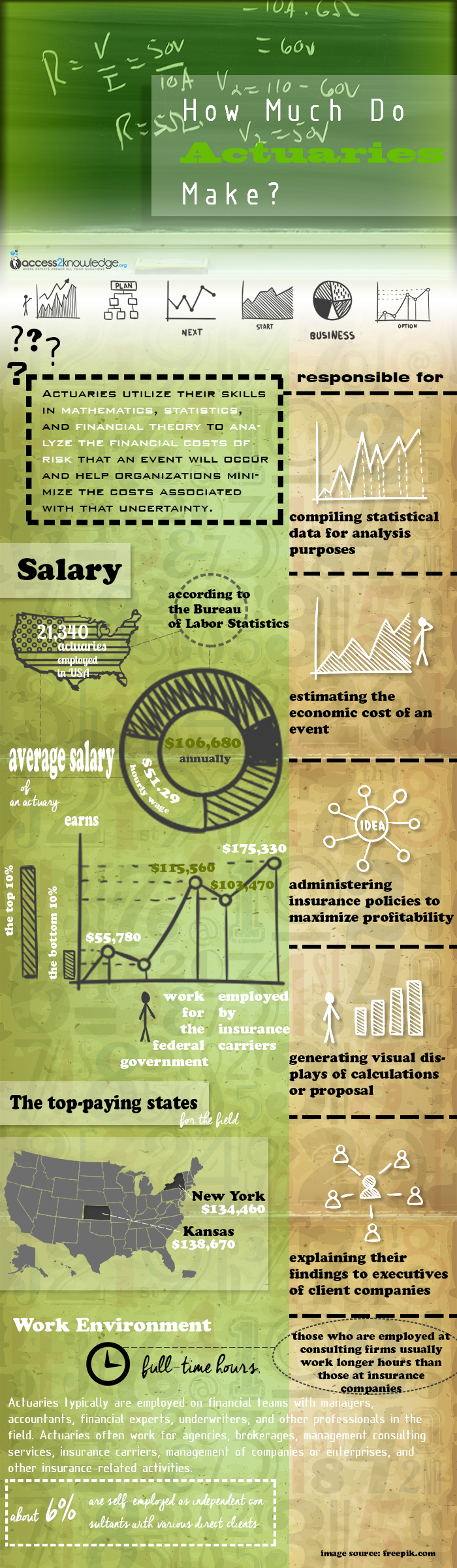

Actuaries are typically responsible for compiling statistical data for analysis purposes, estimating the economic cost of an event, administering insurance policies to maximize profitability, generating visual displays of calculations or proposals, and explaining their findings to executives of client companies.

Salary

How much does an actuary make? According to the Bureau of Labor Statistics, the 21,340 actuaries currently employed throughout the United States earn an average salary of $106,680 each year, which is equivalent to a mean hourly wage of $51.29.

While the bottom ten percent in the profession earns $55,780 on average, the top ten percent of actuaries with the most experience bring home an impressive salary of $175,330 annually. Actuaries who are employed by insurance carriers make less than average at an annual salary of $103,470, but the highest paid actuaries work for the federal government for an average $115,560 each year. The top-paying states for the field are Kansas and New York, where actuaries bring home a mean $138,670 and $134,460 respectively.

Work Environment

Actuaries typically are employed on financial teams with managers, accountants, financial experts, underwriters, and other professionals in the field. Actuaries often work for agencies, brokerages, management consulting services, insurance carriers, management of companies or enterprises, and other insurance-related activities. About six percent of actuaries are self-employed as independent consultants with various direct clients. Although most work within an office setting using a computer for analysis, some actuaries are required to frequently travel to meet with clients. The majority of actuaries work full-time hours, but those who are employed at consulting firms usually work longer hours than those at insurance companies.

Actuaries will be in high demand in the insurance industry as the professionals will be increasingly in need for developing, pricing, and evaluating a variety of insurance products. With the changing laws surrounding health insurance, more actuaries will be necessary to evaluate healthcare plans for corporations and evaluate the effects to changes in coverage. Employment is expected to grow faster than the national average at a rate of 27 percent, which will create 5,800 new jobs for actuaries before 2020.

Add This Infographic to Your Site

Leave a Reply