While a lot of people use the financial terms credit report and credit score interchangeably due to their related nature, they are not the same thing. Making the mistake of confusing your credit report and credit score can end up costing you.

For those of you who are completely lost in the financial jargon surrounding credit, the following is an overview of how credit scores and credit reports differ, their purposes, and how they can potentially have a large impact on your financial situation.

Your Credit Report

Credit reports are compiled by the three credit bureaus, also referred to as credit reporting agencies, based on the information that is received about your accounts from the reports of various corporations, credit card companies, and banks. The information is condensed into a standard credit report in order to be made available to third parties, including prospective lenders and employers, to offer a financial background about whether the individual is financially stable. Whenever you are applying for a new mortgage, loan, credit card, account, or lease, it is highly likely that the company will request a current copy of your credit report from one of these bureaus to check you out beforehand.

Credit Score

Secondly, the credit score is the actual number that has been assigned to your credit report by the three credit bureaus based on your credit history. The purpose of the score is to indicate to third parties the likelihood that you will repay your loans on time and explain how credit worthy or unworthy you may be. While explaining the exact math to creating the score would likely make your head spin, it is important to know that each of the bureaus utilizes their own complex algorithm to generate this magic numerical value that is considered your credit score.

FICO Score

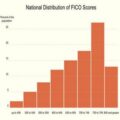

Despite the fact that there are countless formulas, the most widely used by creditors is referred to as the FICO score. Ranging from 300 to 850, scores under 400 are a major source for concern and scores over 700 are extremely healthy. The higher your score climbs on the scale, the more it proves to lenders that you are less likely to default or become delinquent on your accounts. In generating your score, the bureaus center on your payment history, amount of debt, length of credit history, and new credit – thus the content of your credit report affects your credit score, but they’re not the same thing.

If you have ever rented an apartment, subscribed to cable, or applied for a new job, there is a high chance that your credit report or credit score was perused. Although some creditors will focus on the powerful little number that is your credit score, others will dig a bit deeper past the surface into your credit report.

Since the credit score highly depends on the information within the report, you do not need to be overly concerned about which method a lender searches through. If you have a strong credit report, you will also have a high credit score, and vice-versa. Therefore, whatever you do to improve the state of your credit report will also help to boost your credit score in digits too.

Leave a Reply